Built for Alpha. Driven by Data. Disciplined by Design.

SharpeQuant Capital is a quantitative research and technology firm focused on the development of systematic investment models and trading signals.

The firm’s research and model outputs are designed for evaluation and potential use by duly registered portfolio managers and investment fund managers.

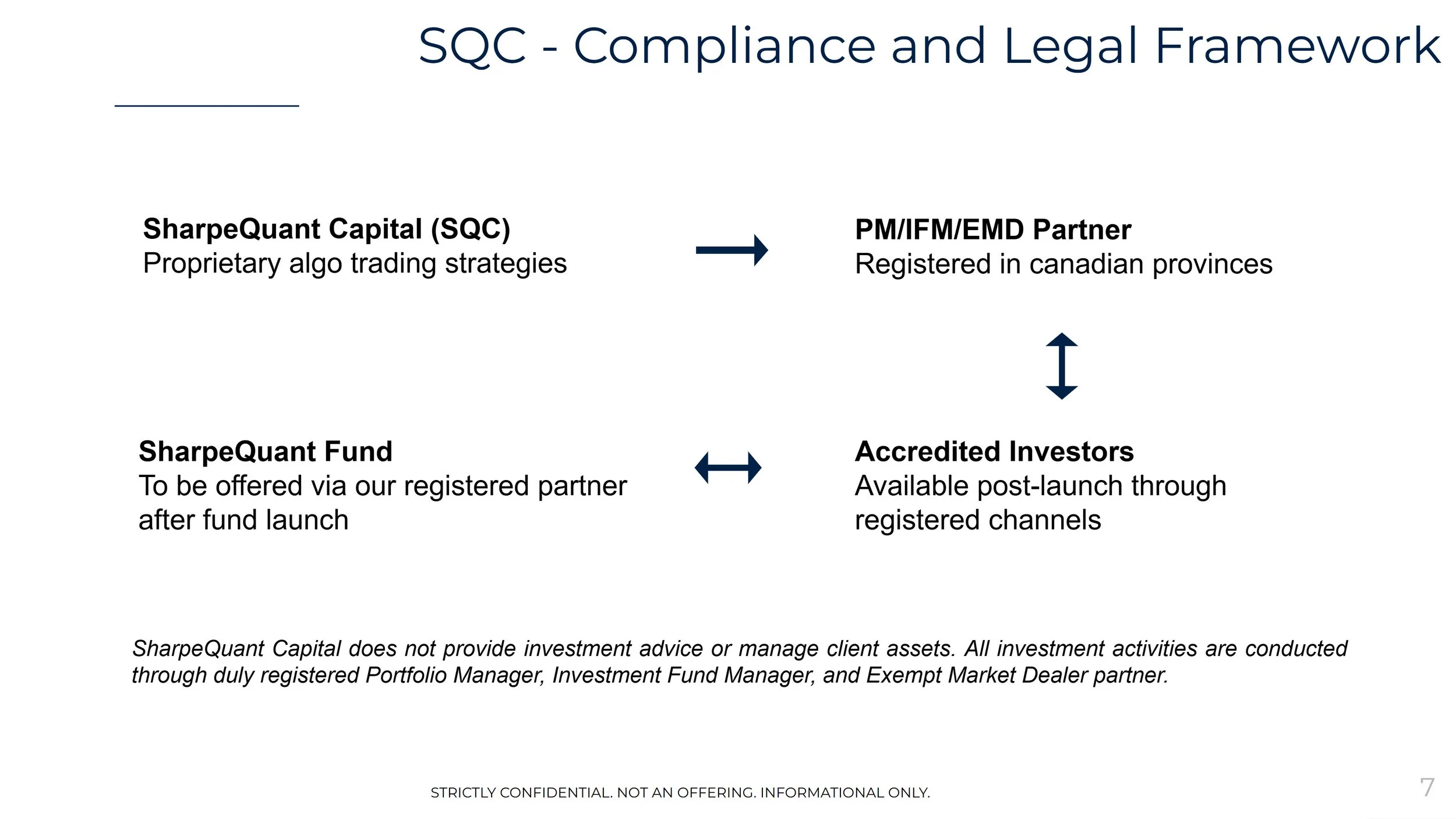

Any investment products that reference SharpeQuant-developed models are offered, managed, and distributed exclusively by registered firms that retain full discretion, regulatory responsibility, and client-facing obligations.

SharpeQuant Capital does not manage client assets, does not offer or distribute securities, and does not engage in any activity requiring registration under Canadian securities legislation.

Important Disclosure – Simulated Performance

The performance results shown are simulated and based on backtested data using SharpeQuant Capital’s proprietary research models. These results are hypothetical, do not represent the performance of any actual fund or client account, and were achieved with the benefit of hindsight. Simulated performance has inherent limitations and relies on assumptions that may not reflect real-world factors such as transaction costs, liquidity, market impact, or execution constraints. Actual results may differ materially. Past simulated performance is not indicative of future results. SharpeQuant Capital does not provide investment advice, manage client assets, or offer or distribute securities. Any investment fund referencing SharpeQuant-developed models is managed and offered exclusively by a duly registered Portfolio Manager and Investment Fund Manager, which retains full discretion and regulatory responsibility.

Our Vision

To lead global finance through data science and quantitative innovation.

Our Mission

To deliver superior risk-adjusted returns with fully automated, data-driven strategies built on scientific rigor and institutional discipline.

Our Values

Integrity – Transparency and trust in every decision.

Innovation – Relentless pursuit of smarter, science-based solutions.

Collaboration – Diverse minds, unified to drive lasting performance

Meet the Founder – CEO & Visionary Behind SQC’s Quantitative Trading Technology

Driven by Passion, Powered by Precision.

Lisa Chen is a seasoned entrepreneur, trader, and visionary fintech leader with over two decades of experience at the intersection of financial markets, quantitative technology, and business innovation.

Her career began in finance at age 21, when she became licensed through the Canadian Securities Institute and began executing trades across equities, options, fixed income, and mutual funds at a Canadian national brokerage firm. This early experience laid the foundation for her deep understanding of market mechanics and disciplined execution under pressure.

She later combined entrepreneurial drive with sharp operational instincts, helping scale a two-person venture into Canada’s largest distributor of sign and graphics technology, systems and supplies – earning her a finalist spot for the EY Entrepreneur Of The Year® awards.

Following the company’s acquisition and a brief retirement, Lisa returned to the markets to develop methodologies and fully automated algorithmic strategies. She went on to earn a Top 5 global ranking in one of the world’s most respected trading competitions – widely regarded as the gold standard in live trading since 1983, requiring full transparency and real capital. Her performance led to selection among a small group of elite traders whose verified strategies are tracked and followed through an institutional-grade auto-execution platform trusted by global investors.

Today, Lisa is the CEO of SQC, a quantitative trading technology firm powering institutional investment funds with fully automated, data-driven portfolio strategies. She leads a team of quantitative strategists and oversees the firm’s proprietary SharpeQuant (SQ) platform – used by licensed fund managers and professional investors to optimize performance, scalability, and risk-adjusted returns.

Outside the boardroom, Lisa is also a former race car driver with dozens of podium finishes across North America. Her high-performance mindset on the track mirrors her approach to trading and leadership – disciplined, data-driven, and relentlessly focused on execution.

Meet the Team

-

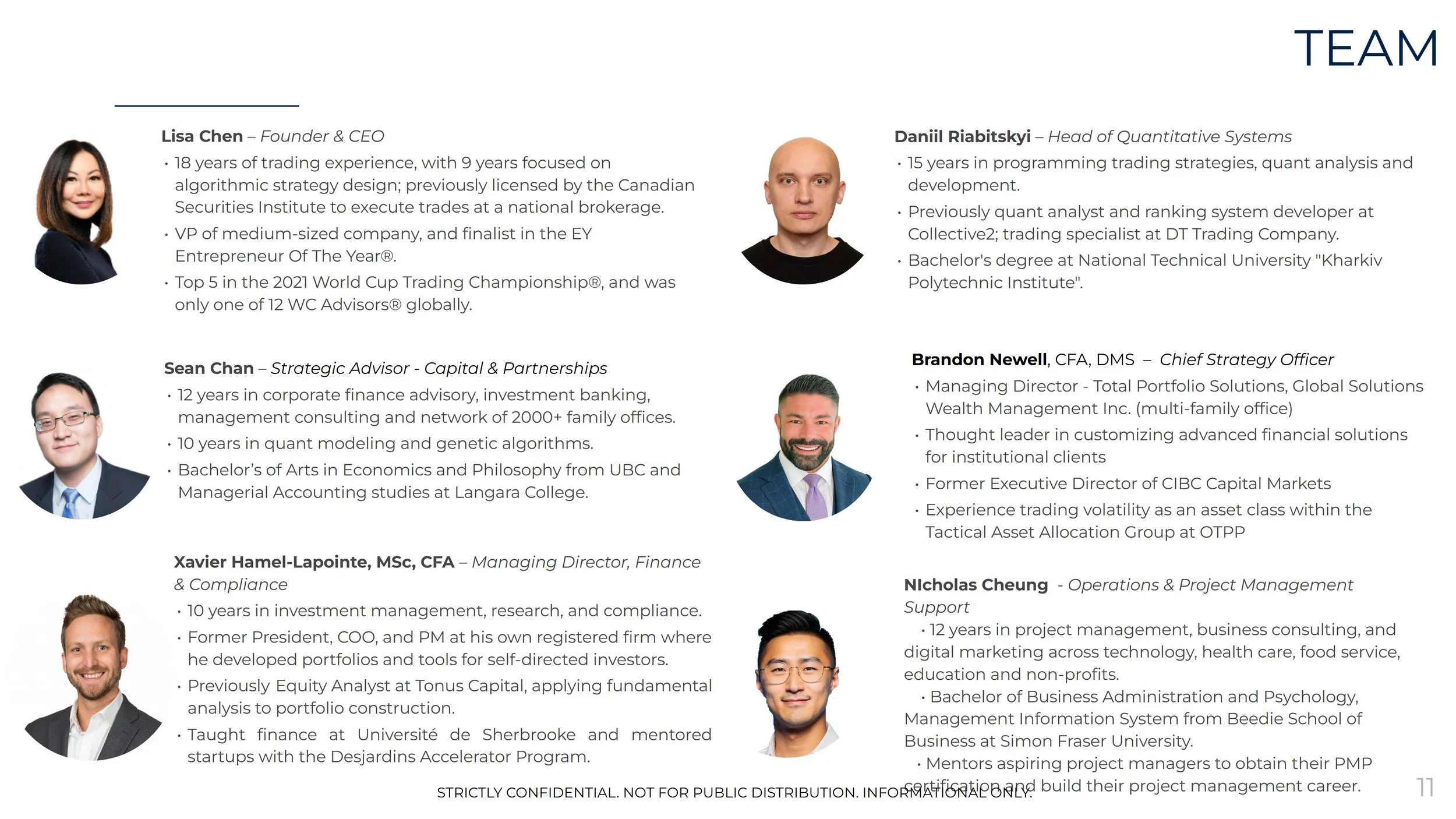

Lisa Chen

Chief Executive Officer

Lisa is Founder and CEO. She brings 18 years in trading, including 9 focused on algorithmic strategy design, was CSI-licensed to execute trades at a national brokerage, previously served as a VP, placed Top 5 in the 2021 World Cup Trading Championship®, was an EY Entrepreneur Of The Year® finalist, and was one of 12 World Cup Advisors® globally.

-

Xavier Hamel-Lapointe, CFA

Managing Director, Finance & Compliance

Xavier is Managing Director, Finance and Compliance. He brings an MSc, the CFA charter, and 10 years of experience spanning investment management, research, and compliance, including leadership of his registered firm, prior equity analysis at Tonus Capital, and teaching and mentoring roles with Université de Sherbrooke and the Desjardins Accelerator Program.

-

Brandon Newell, CFA

Chief Strategy Officer

Brandon is Chief Strategy Officer. A thought leader in institutional solutions, he holds the CFA and DMS designations, has led Total Portfolio Solutions at Global Solutions Wealth Management Inc. (multi-family office), previously served as Executive Director at CIBC Capital Markets, and has hands-on experience trading volatility in OTPP’s Tactical Asset Allocation Group.

-

Daniil Riabitskyi

Head of Quantitative Systems

Daniil is Head of Quantitative Systems. He brings 15 years in programming trading strategies and quantitative research, previously served as a quant analyst and ranking-system developer at Collective2, traded at DT Trading Company, and holds a bachelor’s from the National Technical University “Kharkiv Polytechnic Institute”.

-

Nicholas Cheung

Operations & Project Management Support

Nicholas is Operations & Project Management Support. Administration Support. He brings 12 years in project management, business consulting, and digital marketing across technology, health care, food service, education and non-profits. Bachelor of Business Administration and Psychology, Management Information System from Beedie School of Business at Simon Fraser University. Mentors aspiring project managers to obtain their PMP certification and build their project management career.

Advisors

-

Walter J. Gallwas

Walter brings over 28 years of leadership in trading systems, managed futures, and alternative investments to LCT’s Advisory Board. As a pioneer in system-assisted trading, he co-developed one of the first platforms allowing investors to access automated strategies -helping transform how portfolios are managed and scaled across the industry.

He is the Founding Partner of Attain Capital Management and served as Managing Director at RCM Alternatives, where he guided institutions and high-net-worth clients through complex markets with a focus on disciplined, risk-managed strategies. He also launched Attain Portfolio Advisors to expand investor access to leading commodity-based managers.

As Co-Founder, Principal and Managing Director of iSystems and iBroker, Walter continues to lead innovation in trading technology, platform integration, and scalable infrastructure. His expertise spans portfolio construction, product development, and regulatory best practices - making him an invaluable strategic voice as LCT expands its institutional offerings.

Walter holds a degree in Economics from Washington State University and has previously held regulatory affiliations with the CFTC, NFA, MFA, and CBOT. His commitment to transparency, investor protection, and operational excellence closely aligns with LCT’s mission to deliver institutional-grade performance through quantitative automation.

-

Paul Chow

Paul has over 25 years of experience in the capital markets, specializing in corporate finance, strategic planning, and business development. Over the course of his career, Mr. Chow has served as a director and officer of both private and publicly traded companies, providing leadership and oversight across a wide range of corporate functions, including financing, marketing, and operational management.

Mr. Chow has been actively involved in multiple sectors, including technology, oil and gas, mining, and agriculture, contributing to the advancement and commercialization of numerous projects within these industries. His experience also includes assisting companies in preparing for and completing initial public offerings (IPOs), as well as guiding organizations through various stages of corporate growth and market expansion.

As an entrepreneur, Mr. Chow continues to be engaged with a number of public and private enterprises at different stages of their development, offering strategic insight and fostering long-term value creation.

-

Sean Chan

As Strategic Advisor - Capital & Partnerships, Sean brings over 12 years of experience in corporate finance advisory, investment banking, and management consulting, with demonstrated expertise in strategic growth, capital formation, and investor relations across multiple sectors.

He has advised and collaborated with single- and multi-family offices, investment funds, and corporations - building long-standing relationships within a global network of over 2,000 institutional and family office investors.With an additional decade of work in quantitative modeling and algorithmic strategy design, Sean blends analytical rigor with financial insight to help SharpeQuant strengthen its partnerships and AUM capital-raising initiatives across key markets.

He holds a Bachelor of Arts in Economics and Philosophy from the University of British Columbia and has pursued advanced studies in Managerial Accounting at Langara College.

Scientific - Data focused

·

Approachable

·

Genuine

·

Passionate

·

Progressive

·

Honest

·

Innovative

Scientific - Data focused · Approachable · Genuine · Passionate · Progressive · Honest · Innovative

Honest

·

Precise

·

Scientific - Data focused

·

Innovative

·

Honest

·

Credible

·

Honest · Precise · Scientific - Data focused · Innovative · Honest · Credible ·